|

|

An operational referendum allows a school district to exceed the state-imposed revenue limit to fund essential day-to-day expenses such as utilities, maintenance, and staff salaries. It helps address funding gaps while ensuring that 100% of the referendum tax dollars stay within the district to support local priorities and goals.

Many communities rely on an operating referendum to keep schools running and make sure students get the education our community expects. Since 1990, 87% of Wisconsin School Districts have asked their communities for an operational referendum. Dodgeland is among the 13% of school districts in Wisconsin that have not asked for an operating referendum yet.

The question on the ballot is:

Shall the Dodgeland School District, Dodge County, Wisconsin be authorized to exceed the revenue limit specified in Section 121.91, Wisconsin Statutes, by $1,400,000 for five (5) years beginning the 2025-2026 school year and concluding the 2029-2030 school year, for non-recurring purposes consisting of operational expenses, including to maintain student to staff ratios, educational and co-curricular programs, student behavioral and mental health resources, and technology and cybersecurity infrastructure?

Like most school districts in Wisconsin, the Dodgeland School District is facing a budget shortfall due to:

-

School Funding Challenges: The majority of Wisconsin school funding comes from the revenue limit formula, which was set by Act 16 in 1993. Districts, like Dodgeland, that were fiscally conservative started at a very low revenue limit compared to higher spending districts. Any revenue limit increases that have occurred since 2009 have not kept pace with the rate of inflationary costs. There were ZERO increases to revenue limits from 2020 - 2023.

The 2023 - 2025 biennial budget set the current minimum revenue limit to $11,000 per pupil. Dodgeland was below this minimum level prior to the 2023 - 2024 school year.

-

State Budget Challenges: The State of Wisconsin approves a biennial budget every two years, with the most recent budget passed in July 2023. However, since 2013, state funding for public schools has not kept pace with the Consumer Price Index (CPI) rate of inflation, resulting in an estimated cumulative shortfall of $2,302 per student. Additionally, the state reimburses only 33% of special education costs, requiring our district to allocate an additional $1.29 million from general funds each year to ensure students with disabilities receive the necessary services and supports.

-

Inflationary Challenges: School district costs are rising faster than revenues, creating significant financial challenges. We have experienced substantial increases in expenses across the board, including health insurance, property and liability insurance, utilities, transportation, cybersecurity infrastructure, building maintenance, and special education. Despite making difficult budget reductions in staffing and operations, we have been unable to keep pace with inflationary costs. As a result, we are now operating on a deficit budget, making it increasingly difficult to maintain the quality of education and services our students deserve.

The operating referendum would allow the district to:

-

Maintain current programs and services for students

-

Maintain appropriate class sizes, instructional materials and staff training

-

Attract and retain high-quality staff

-

Maintain technology and cybersecurity infrastructure

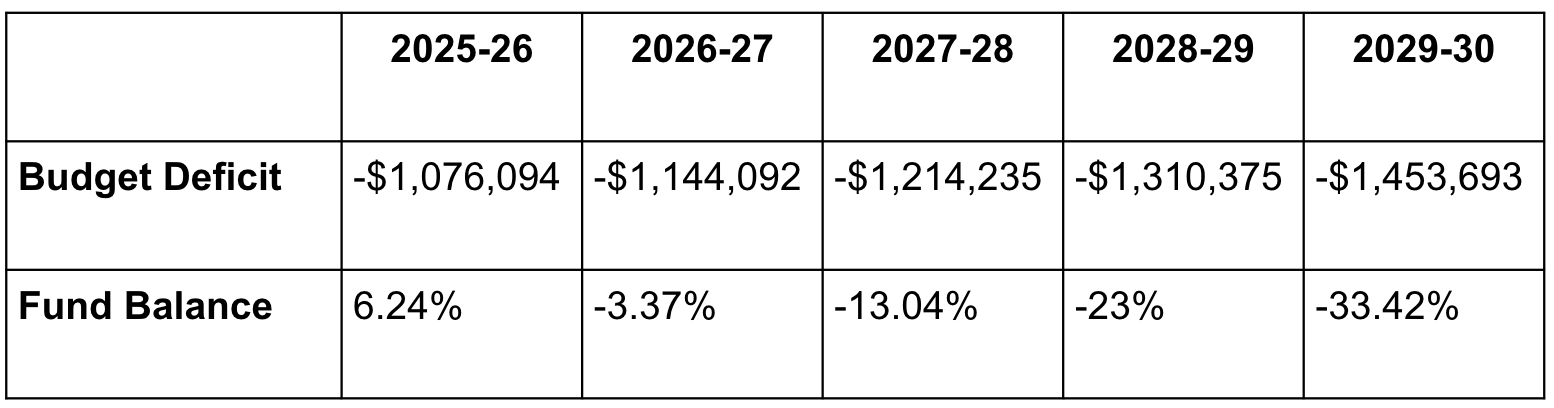

If the community does not approve the referendum, the district is projected to experience a $1,076,094 budget deficit for the 2025-26 school year and put the district fund balance below policy (15%) at 6.24%.

If all current programs are maintained (including student to staff ratios) without any increases in revenue, the fund balance is predicted to decrease as follows:

The school district has already made significant cuts in staffing and operations, yet is operating on a deficit budget this school year. Without the referendum, the school board will need to consider even more significant cuts to essential programs, services, and staff.

Major cuts to essential programs and services will be unavoidable. Financial cuts will impact class sizes, class offerings (electives), co-curricular activities, and behavioral and mental health supports and resources we provide our students.

A facilities or capital referendum allows a district to take out a loan (issue debt) to pay for major facility projects. Much like a home mortgage, a capital referendum is typically financed over an extended period of time, such as 20 years.

In 2020, Dodgeland residents passed a capital referendum which was used for district-wide facilities improvements: a new roof, HVAC upgrades, window repair and replacement, renovation of classroom and learning spaces at all grade levels, a 4,000 SF STEM addition, secure entrances and security updates, and playground and parking lot improvements.

The state biennial budget determines the annual allowable increase in revenue and puts a cap on funding from the combination of property tax and state aid. For many years, the state budget allowed NO increase in the state-imposed revenue limits, while inflation was at historically high levels. This caused a significant challenge for rural school districts like ours. With a lack of consistent, predictable, sustainable funding, 87% of school districts in Wisconsin have needed to secure additional funding through a voter-approved referendum.

Dodgeland has been fiscally responsible for years, making significant cuts in staffing and operations. However, rising costs and budget shortfalls have now made it difficult to sustain current programs and services, appropriate class sizes, instructional materials, staffing, and essential technology and cybersecurity infrastructure.

The district has taken a variety of actions to address financial challenges over the past five years, including a reduction of staffing and operational expenses.

-

Eliminated 8 teaching positions, including German, High School English, Reading/Math Interventionist, Music, PE, Art, Tech Department, and a part time Gifted/Talented teacher

-

Increased class sizes from 18 to 22 in 4K through 3rd grade classrooms.

-

Class sizes in 4th to 12th grades vary in size up to 31.

-

Projects and purchases have been delayed, cancelled, or adapted due to budget shortfalls.

-

Federal ESSER funds intended for pandemic-related needs had to be used to balance our budget because the state provided no inflationary increases to school funding.

-

The School Board approved a $655,816 deficit budget for 2024-25, covered by a healthy fund balance. However, the district is borrowing this year, and operating on a deficit is not sustainable long-term.

We used projected increases for next year’s expenses based on the Consumer Price Index (CPI), known increases we have been informed of, and estimates for projected salary and fringe benefit cost increases. We also made assumptions on all other educational costs based on historical data.

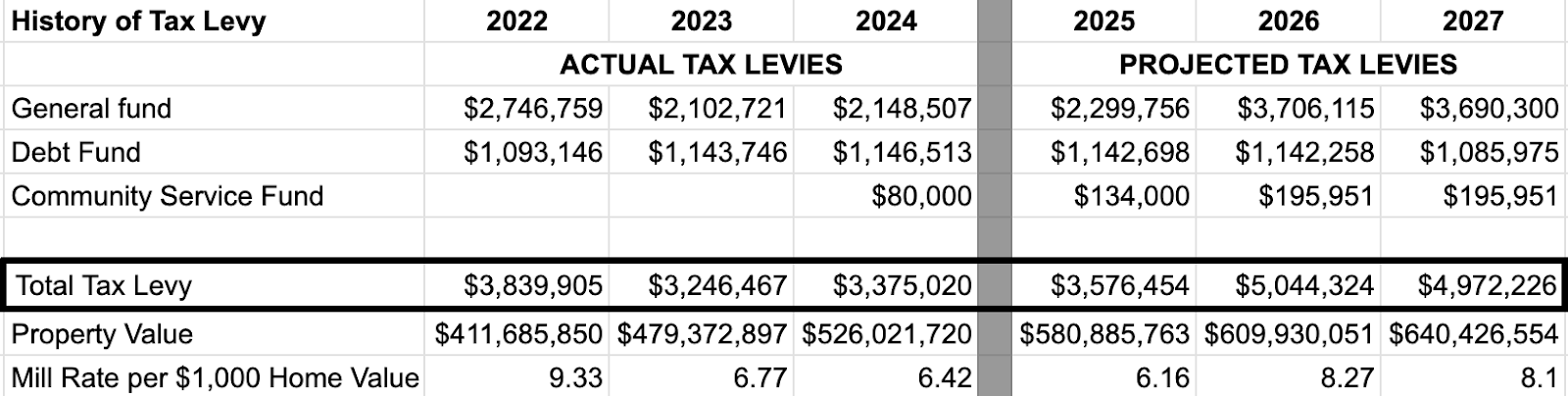

An approved referendum would have an estimated school district annual property tax increase of $2.11 for every $1,000 of equalized property value. The increase on a home with an assessed fair market value of $200,000, for example, would be approximately $422 per year.

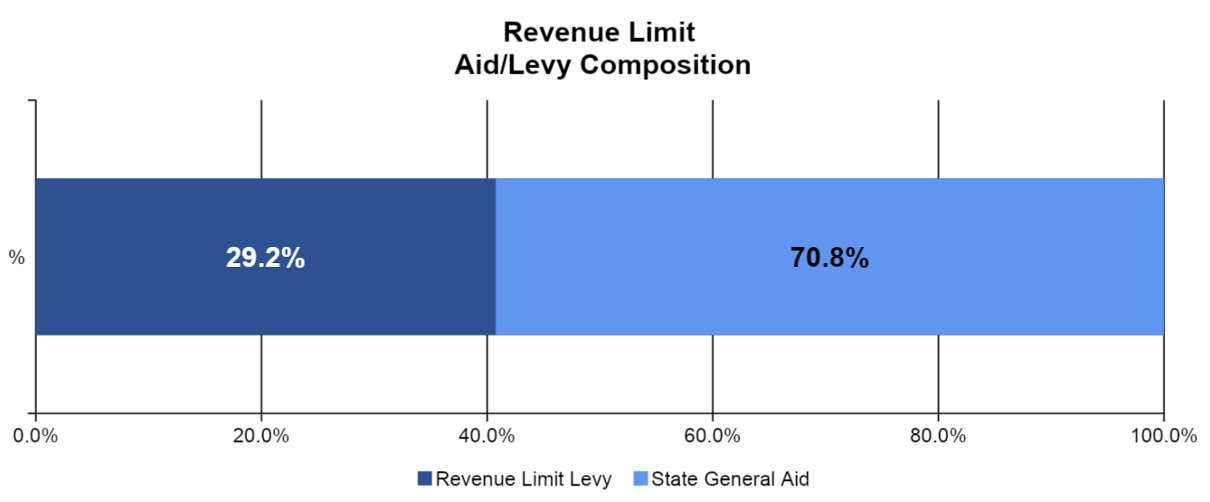

It is important to know that the full amount of the operating referendum is not levied to the taxpayers. A portion of the revenue limit funding comes in the form of state aid. In this example, we can see that the state aid portion of the revenue limit was 70.8% while the local tax portion was 29.2% in 2024 - 2025.

2024 - 2025

The state aid contribution changes each year depending on the amount included in the state’s budget for school districts, changes in local expenses, student enrollment, and property values. The referendum dollars will also be aided and not fall fully on the taxpayer.

Dodgeland School District has worked with historical models and has projected future expenses to arrive at a reasonable assumption for future tax effects if this referendum is approved. (The mill rate represents the property value divided by the total tax levy).

For the 2024-25 school year, the mill rate was $6.16 per $1,000 of home fair market valuation. The property tax rate for the district has steadily decreased since its highest documented rate of $13.189 in 2013-14.

The mill rate is the amount of property tax charged per $1,000 of a property's equalized value. It ensures taxes are distributed fairly based on property values rather than equally among taxpayers. School district taxes cover operations, debt service, and community services.

District residents can vote on Tuesday, April 1, 2025. Polls are open from 7:00 a.m. to 8:00 p.m.

|

|

|